People who didn’t file 2018 or 2019 federal income tax returns needed to take an extra step this past spring to receive government stimulus checks for their children. However, a glitch in the IRS non-filers tool meant people who requested payments prior to May 5, 2020, may not have received the promised $500 per child.

To correct the mistake, the IRS has reopened the non-filers tool so people can enter information for eligible children. It will be available from Aug. 15 to Sept. 30, after which the window will close to request the money this year. Those who miss the deadline may still be able to claim the $500 payment as a credit by filing a 2020 tax return next spring.

Programming Error Meant Missed Payments

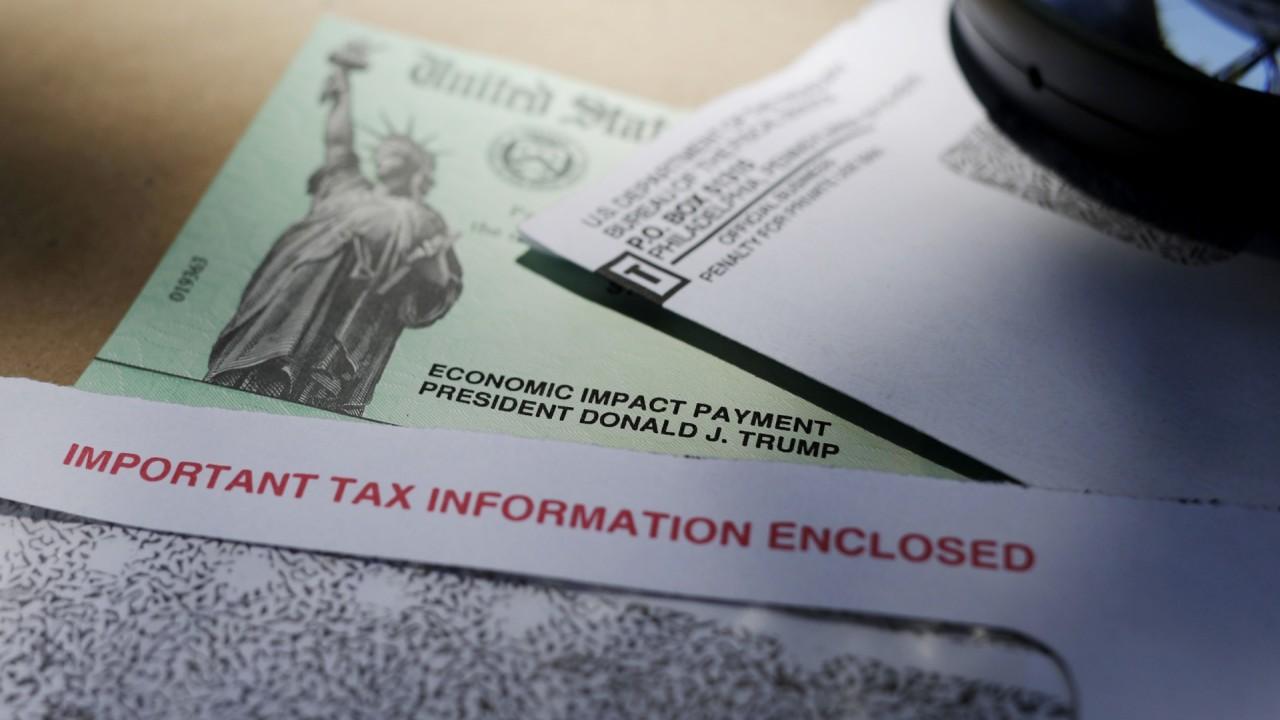

Thanks to the Coronavirus Aid, Relief and Economic Security Act, millions of Americans received economic impact payments this past spring. These stimulus checks distributed up to $1,200 to individual adults with incomes less than $99,000 per year and also provided $500 per child younger than age 17.

Most people didn’t have to do anything to receive the payments, which were automatically sent based on a person’s 2018 or 2019 tax return. However, non-filing parents may have missed out on the $500 stimulus payment for their children.

“The IRS figured out there was a problem for people who don’t file a tax return,” says Timothy Speiss, co-leader of the personal wealth advisors group at accounting firm EisnerAmper in New York City.

Launched in the spring, the non-filers tool was intended to expedite stimulus checks to those who aren’t required to file tax returns because they don’t earn enough or only have exempt income. Although the tool allowed non-filers to claim their personal economic impact payments, a programming error meant money for some children was not sent. Although the error was corrected in mid-May, it was too late to help early users of the tool.

Who Should Use the Non-Filer Tool Now

Taxpayers can receive a $500 stimulus payment for each qualifying child in their household. Eligibility follows the same general rules of the child tax credit which requires children to be younger than 17, live with the taxpayer for more than half the year and rely on that person for at least half their support.

Non-filers should access the IRS tool before Sept. 30 if they have not already used it to claim their qualifying child’s economic impact payment. Anyone who used the tool prior to May 5 also needs to access it again to input their children’s information. Those who used it after May 5 don’t need to take any further action. Their $500 child stimulus payments will be issued automatically in October, according to the IRS.

“If someone plans to file for 2019 and hasn’t yet, they can’t use this tool,” says Kirsten Toler, a CPA and senior tax manager with accounting firm Friedman LLP. Doing so could delay processing the tax return and any refund owed.

Filing a return might be an option worth considering for those who haven’t already used the non-filers tool. “There may be benefits you didn’t know about,” says Paul Miller, CPA and managing partner with New York City-based accounting firm Miller & Company, LLP. “You could be eligible for the earned income tax credit.”

This credit is refundable, which means eligible low-income households could receive a refund even if they don’t owe any tax. Other refundable credits may be available at the state and local level, depending on where someone lives.

How to Use the Stimulus Payment

Stimulus payments aren’t expected to be issued until this fall, which gives parents time to consider where to use the extra cash. “A great use of this money could be to pay down high interest rate debt,” Speiss says.

In the event someone has minimal debt or no pressing expenses, it might be wise to simply deposit the money in a high-yield savings account for the time being. “I always think people need bunker money,” Miller says. He defines this as emergency cash that can be used as a last resort and could be helpful if the pandemic drags on and assistance programs such as enhanced unemployment benefits end.

Investing money can also be a smart use of this cash. For instance, depositing it into a 529 account will allow money to grow and be withdrawn tax-free for qualified education expenses. In some states, the deposit might qualify for a tax deduction as well.

Regardless of how you plan to use the money, be sure to submit your request using the IRS non-filer tool by Sept. 30. “Spread the word,” Toler says. “You never know who can benefit from this.”