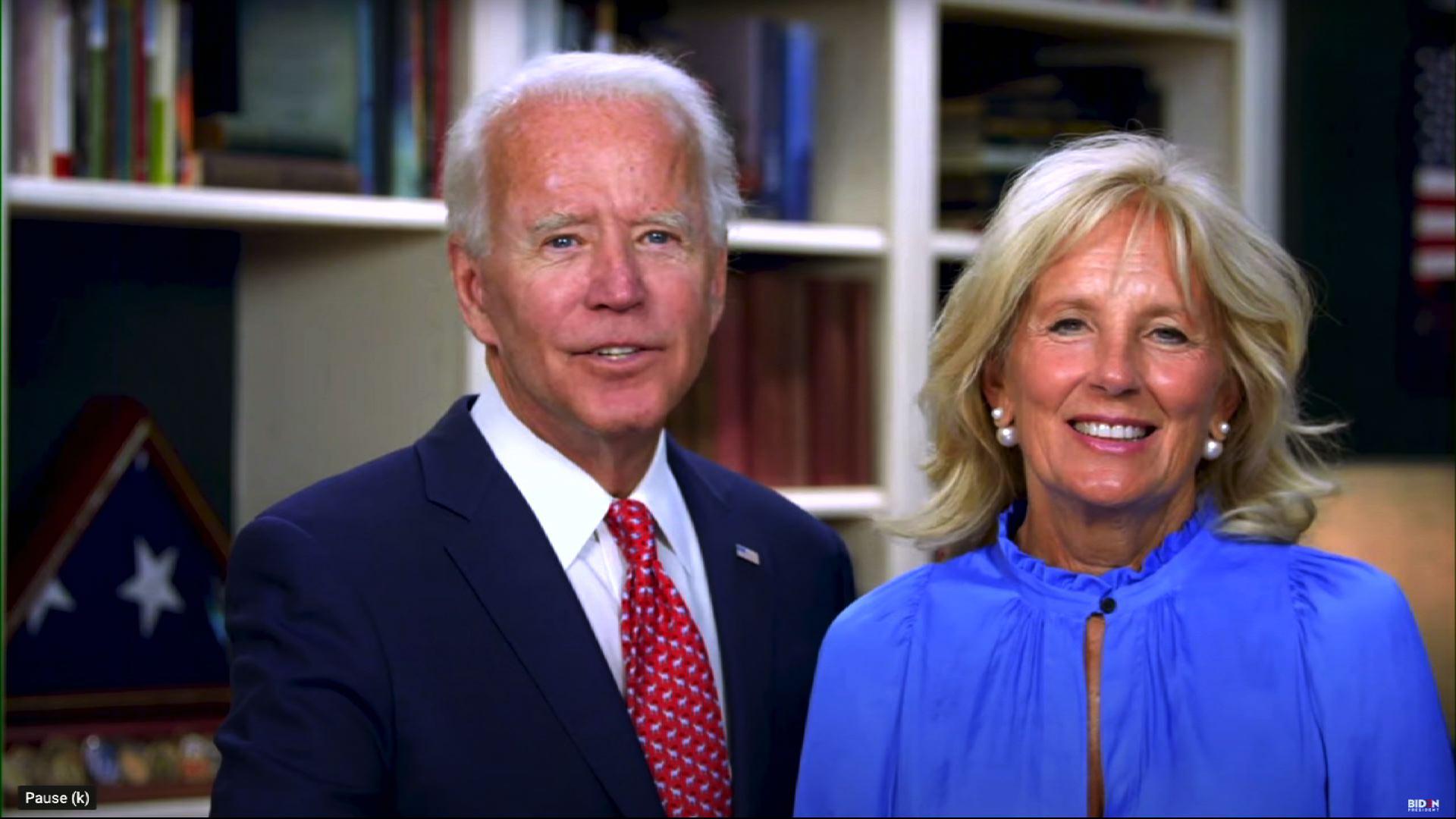

Former Vice-President Joe Biden unveiled his plan Tuesday to help American families afford and access care for their children and elderly loved ones.

The $775 billion package of proposals is the third plank of his Build Back Better plan aimed at creating millions of jobs and shoring up an economy badly battered by the coronavirus pandemic. Biden is the presumptive Democratic candidate for president.

Here are the key takeaways that could affect your family budget:

Tax credits for the middle class

For households earning less than $125,000 annually, Biden proposed a refundable tax credit of up to half a family’s child care costs for children under 13. It would max out at $8,000 for one child or $16,000 for two or more children. Families earning between $125,000 and $400,000 will qualify for partial credits.

A ceiling on the cost of child care

Biden’s plan would cap child care costs for many families. No household with children under 5 and earnings less than 1.5 times the state average would pay more than 7% of their income for child care. Subsidies, provided by both the federal and state governments, would be based on a sliding scale.

Paid time to care for loved ones

Biden’s plan would offer up to 12 weeks of paid family and medical leave, enabling workers to take time off to care for ill relatives without losing their income.

Free early education

Biden is proposing free preschool for 3- and 4-year-olds.

Incentives for business

Businesses would be encouraged to build more child care facilities, as well as improve homes for the elderly and disabled. Employers would get a federal tax credit equal to half of the first $1 million they spend on building a facility.