If you’ve ever wondered how banks set their interest rates and why they fluctuate, it can help if you understand the Federal Reserve’s funds rate. Considered to be the most important interest rate in existence, it impacts all other interest rates. The funds rate is a tool used by the Federal Reserve to influence the economy and set monetary policy.

What is the Fed funds rate?

Banks are required by law to keep a certain level of cash at their regional branch of the Federal Reserve to ensure their customers can withdraw money from their accounts. Some banks hold excess reserves. When another bank doesn’t have enough reserves to meet the legal requirement, a bank with excess funds will lend it money on an overnight, unsecured basis. The funds rate is the interest rate charged by the loaning bank. The Federal Reserve is in charge of setting the funds rate. This rate influences the prime rate, which is what banks charge their best customers.

How does the Fed cutting interest rates affect me?

Lower interest rates could benefit you if you’re interested in getting a personal loan, private student loan, mortgage, or home equity loan. The Fed funds rate impacts the rates banks charge for these types of loans. When the funds rate is low, banks reduce the prime rate, which results in lower interest on consumer debt.

When the Fed cuts the funds rate, you may also get better rates for refinancing your mortgage or student loans.

How should I handle interest rate changes?

Understanding why rates rise or fall can help you make better decisions. For example, it may be time to refinance an existing loan if the current interest rate is lower than the one you have.

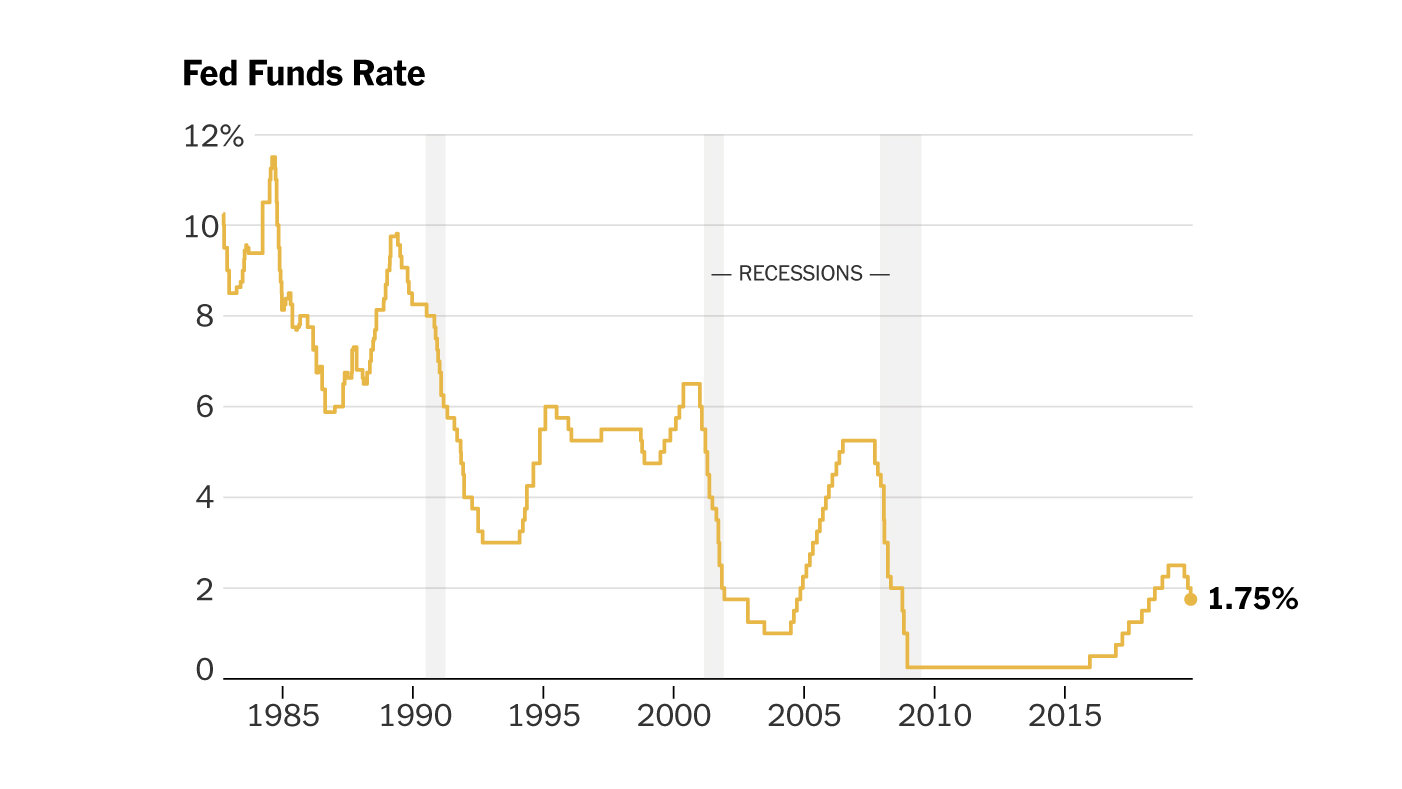

The Fed funds rate rises and lowers on a cyclical basis. Knowing that there will be ups and downs, you can take steps to save money and make sound financial decisions for your future.

How does the Fed raising interest rates affect me?

When the Fed raises rates, it’s called a contractionary monetary policy. If you need to borrow money, you will be charged a higher interest rate. And if you have an adjustable-rate mortgage that fluctuates with the economy, your monthly payment will go up. Raising the funds rate can slow down the housing industry, and the prices of homes can go down, creating a buyer’s market.

But raising the funds rate isn’t wholly negative; you can benefit if you have savings accounts. Rates on certificates of deposit, money market accounts, savings, and interest-bearing checking accounts will increase as banks pay you a higher amount of interest to use your money.

Why does the Fed lower or raise interest rates?

The Federal Reserve has two primary purposes: keep unemployment rates low and inflation in check. One way it can accomplish these tasks is through the funds rate. Lowering the rate is called an expansionary monetary policy. When the Fed decreases the rate, it encourages banks to make loans to people and businesses, both of which can stimulate the economy. Businesses might borrow money to spend on capital investments or hiring. And consumers may have the confidence to keep spending.

When debt levels become high, the Fed may raise rates to slow down borrowing. At a more neutral level, businesses or individuals may not be enticed to take out loans because interest rates are low. The Fed may also raise rates to help slow inflation if prices become too high.