It’s not too late to get back an extra refund from your income taxes for 2017, 2018 or 2019. You generally have up to three years after the tax-filing deadline to file an amended return and take advantage of tax credits or deductions you missed in the past – and get back more money from the government – or fix mistakes you made on past returns.

It’s particularly important to file an amended return this year if you made tax-deductible contributions to an IRA, health savings account or self-employed retirement account after you filed your income tax return but before the extended July 15, 2020, deadline for 2019 contributions.

Why to File an Amended Return

You can file an amended return if you discover that you missed out on tax deductions or credits when you originally filed your income tax return or if you made tax-deductible contributions after you filed your return. For example, you’ll need to file an amended return to benefit from tax-deductible IRA, HSA, Simplified Employee Pension (SEP) or solo 401(k) contributions made before the July 15, 2020, deadline but after you filed your 2019 return.

“I have a very bright client who is filing an amended return for 2019 because he decided to add more money into his retirement account,” says Morris Armstrong, an enrolled agent in Cheshire, Connecticut, who is authorized to represent taxpayers in front of the IRS. The client is self-employed and increased his tax-deductible contribution to his SEP account before the July 15 deadline. “He did that because he wanted to invest more at the lower market prices, but also because he was feeling better about his cash flow” than he was when he originally filed his 2019 income tax return earlier that year, says Armstrong.

You may also file an amended return to take advantage of frequently overlooked deductions or credits you missed in past years. For example, the saver’s tax credit can reduce your tax liability by up to $1,000 (or $2,000 if married filing jointly) if you made any contributions to a retirement savings plan, such as an IRA or 401(k). To qualify for the saver’s credit in 2019, your modified adjusted gross income must have been below $32,000 for single filers, $48,000 for head of household or $64,000 if you were married filing jointly. The lower your income, the larger the credit (the income limits were slightly lower in earlier years). See the IRS’ Saver’s Credit fact sheet for more information and the income limits back to 2017.

Other frequently overlooked deductions and credits: You may have been eligible for the American opportunity tax credit, which can be worth up to $2,500 per student if you paid tuition for the first four years of college, or you could qualify for the lifetime learning credit, which can be worth up to $2,000 per year, if you paid tuition for graduate school or continuing education. See IRS Publication 970 Tax Benefits for Education for more information and the income limits.

You may have qualified for the child tax credit if you had kids who were under 13 and you paid for day care, preschool, before-school or after-school care or even summer day camp while you and your spouse worked (or looked for work). The lower your income, the larger the credit, but there is no maximum income limit to qualify. See IRS Publication 503, Child and Dependent Care Expenses for more information.

Armstrong gives new clients a questionnaire that asks about credits and deductions for the current year, and sometimes they realize they were eligible for extra breaks in the past, too. He also asks about deductions that were eliminated after the Tax Cuts and Jobs Act of 2017, which generally took effect in 2018. “We need to be cognizant of pre-2018 returns where more things were eligible for deductions, such as investment advisory fees and unreimbursed employee expenses,” says Armstrong. You can still file an amended return to report eligible deductions for the 2017 tax year.

You can also file an amended return if you discovered mistakes or neglected to report some of your income – for example, if you forgot about a mutual fund redemption or other transaction until you come across the paperwork later on. “That oops moment when you find the unopened envelope marked ‘important tax info,'” says Armstrong.

You may need to file an amended return if information wasn’t available or known when you filed the original return – for example, if you hadn’t received a 1099 reporting certain income by your original filing date, says Jane Rubin, a certified public accountant in St. Louis and member of the AICPA Financial Literacy Commission. Also, some tax law changes are applied retroactively, and you can file an amended return to benefit from the change after you filed your original return, she says.

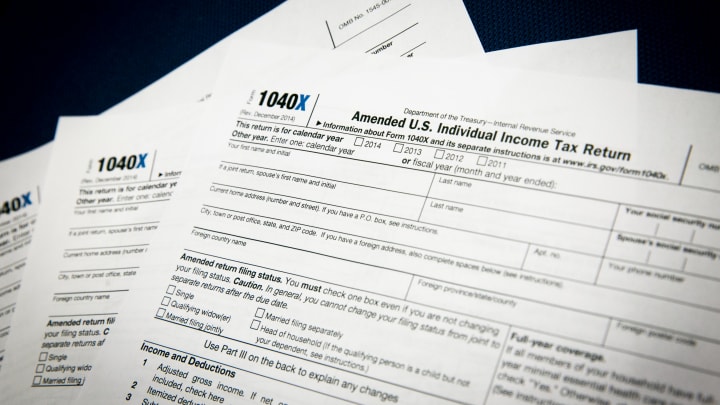

How to File an Amended Return

You usually have to file an amended return on paper, but this year you’ll have the opportunity to file an amended return electronically for 2019 – the electronic option is not available yet, but is currently scheduled to become available by late August, says Trish Evenstad, an enrolled agent in Westby, Wisconsin. The electronic amended return will only be available for the 2019 tax year, not for earlier returns.

When you file an amended return on paper, fill out Form 1040X and mark the year that you’re amending at the top of the form. The form includes separate columns to report the original amount and the changes you are making, and also to submit any additional forms that are affected by the changes (such as Form 8880 for the saver’s tax credit or Form 2441 for the child care tax credit). Compute the corrected tax amount, which might result in a refund or more tax owed, says Rubin. The IRS will send you a check if you’re owed a refund.

You can use the IRS’ Where’s My Amended Return? tool to check on the status of your amended return. You’ll need to provide your Social Security number, date of birth and ZIP code to use the tool. It can take up to three weeks for the amended return to show up in the IRS’ system, and then may take up to 16 weeks to be processed. For more information, see IRS Topic 308 Amended Returns.

You may also need to file an amended state income tax return. “Whenever you amend the federal, I suggest amending the state return unless it has zero impact on the state return,” says Armstrong. “You can always check your state’s website to see if you can make the adjustment online.”